Peer to Peer (P2P) NBFC is registered as a RBI regulated entity – which leverage new age technology to match credit worthy borrowers and lenders basis their risk appetite. It enables the company to deploy the funds of individuals to highly diversified retail prime borrowers; just like how debt mutual funds deploy the funds of the individuals to corporate borrowers thus having the same features as Debt Mutual Funds.

P2P acts like a new asset class for investors. It is a short term, liquid term, liquid debt instrument with significant returns than a liquid/debt fund.

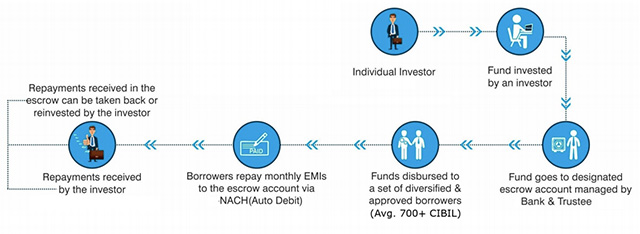

All transactions done on the platform will be mandated through an escrow account which will be managed by RBI approved trustee. Being a RBI regulated ring-fenced structure, all deposits accumulated in the PSU bank escrow account will be disbursed to multiple diversified & approved individual borrowers by the PSU trustee. This creates robust structure safeguarding investor funds thereby providing the lender the lender more confidence & trust.